Reading Financial Statements

Balance sheets and income statements in plain language. You'll learn what each line means and which numbers deserve your attention first.

Financial Ratios Made Clear

Most people think financial ratios are complicated formulas reserved for accountants. They're actually straightforward tools that show how your business performs. We teach you what matters, not endless theory.

Explore Our Program

You don't need to memorize dozens of formulas. These three give you the clearest picture of business health.

Can you pay bills when they're due? This tells you if there's enough cash available without selling equipment or assets. It's about breathing room in your operations.

Are you actually making money, or just staying busy? These numbers separate revenue from profit and show which activities bring real returns versus which ones drain resources.

How well do you use what you have? This measures whether inventory sits too long, if customers pay on time, and where money gets stuck in your business cycle.

We've seen people struggle with textbook approaches that treat ratios like abstract math problems. Our autumn 2025 cohort works with actual business scenarios from Adelaide and broader Australian markets.

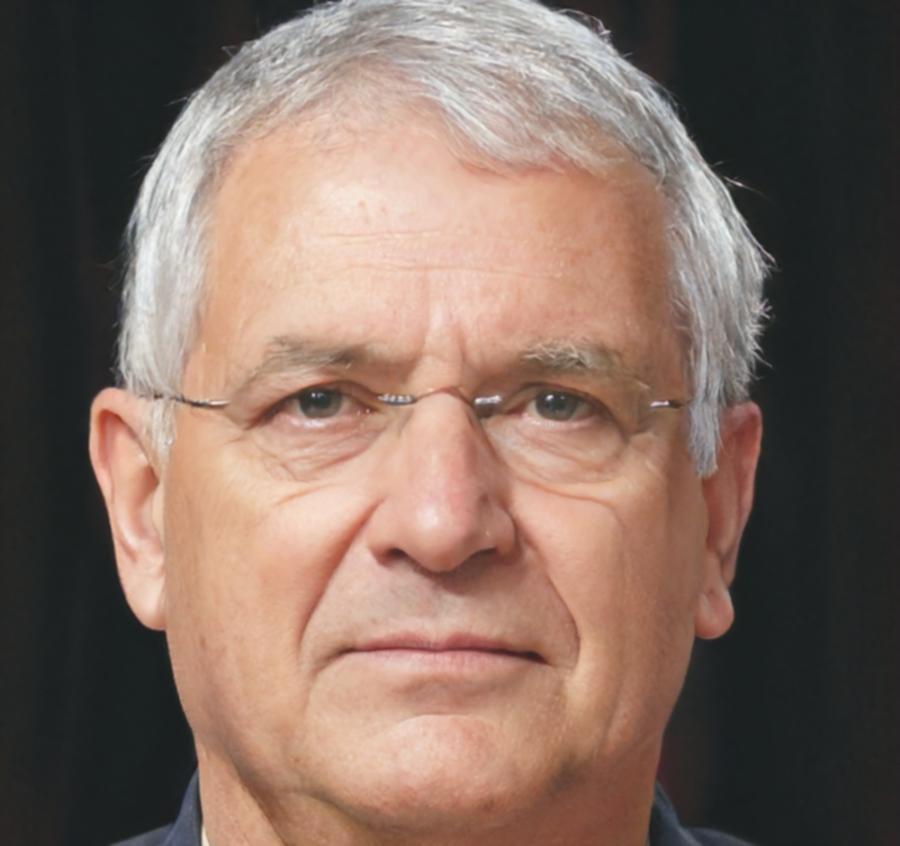

Lead Instructor

Trevor spent fifteen years helping small Australian businesses figure out their numbers. He started teaching after noticing the same confusion about ratios kept appearing. His background includes work with hospitality groups, construction firms, and retail operations across South Australia.

He doesn't believe in complicated explanations. If you can't use it on Monday morning, it's not worth learning on Sunday afternoon.

Four focused modules over twelve weeks, starting September 2025

Balance sheets and income statements in plain language. You'll learn what each line means and which numbers deserve your attention first.

Step-by-step practice with the formulas that matter. We focus on current ratio, gross margin, return on assets, and inventory turnover as foundations.

Numbers alone don't tell the story. Learn to spot warning signs, understand industry benchmarks, and know when ratios reveal opportunities versus problems.

Apply ratio analysis to real situations. Should you extend credit to a new customer? Is it time to reduce inventory? When does growth become risky? Work through these questions with peer groups.

How participants typically progress through the material

First three weeks cover basic financial statement structure and introduce the most common ratios. You'll work with simplified examples before moving to real business data.

Weeks four through eight involve calculating ratios from actual financial statements. Group sessions focus on different industries and what "healthy" looks like in each context.

Weeks nine and ten shift to interpretation. You'll compare companies, track trends over time, and identify when numbers signal opportunities or concerns.

Final two weeks bring everything together with decision-making scenarios. Participants present their analysis and reasoning to the group for feedback.

Our next program begins September 2025 in Adelaide. Limited to eighteen participants so everyone gets individual attention during workshops.